未來中國房價是否會持續下跌?

未來中國房價是否會持續下跌,是一個受到多方面因素影響的複雜問題。當地房地產市場自2021年以來已經出現顯著的下滑趨勢。主要是政府針對過度依賴房地產的經濟模式推行「三條紅線」政策,限制房企的槓桿率,並促使金融機構加強對開發商的信貸控制。此外,經濟不景氣跟人口增長減緩、城鎮化放緩以、建商的持續倒閉及住房需求減少等結構性問題均造成房價一蹶不振。

首先取決於政策的變化,若中國政府繼續保持收緊房地產信貸政策,並限制投資投機活動,那麼房價可能會維持在低位,甚至進一步下降。然而,如果政府考慮經濟增長壓力,釋放寬鬆政策,市場可能會有短期反彈。總體來看,未來中國房價的走勢將受限於住房需求和供應的基本面跟經濟走向,特別是經濟結構轉型中對房地產依賴的調整,這意味著長期增長動力可能受到抑制。過去幾年許多產業紛紛出走,不斷攀升的失業率只會讓房價短期內持續下跌。

目前的狀況已經對多個產業產生深遠影響。首先是房地產開發商和建築行業,這些行業是直接受衝擊的。由於房價下跌,開發商的資金鏈壓力增大,許多大型房企甚至面臨債務違約風險,資金周轉困難,影響到工程建設進度。同時,建築業需求減少也導致相關建材行業如鋼鐵、水泥和玻璃的需求下降,這些上游產業將受到連帶影響。

其次,金融業也是受影響的重點產業之一。銀行長期以來依賴房地產貸款收益,房價下跌和房企的信用風險增高會削弱金融體系的穩定性,銀行不良貸款率上升風險增加。此外,地產行業的低迷對信托基金、保險公司和地產投資基金的投資回報帶來負面影響,金融市場整體投資信心受損。

再次,家庭消費也受到影響。房價下跌帶來的財富效應減少,讓消費者的購買意願降低,特別是對耐用消費品如汽車和家電的需求或有所減少,進一步削弱消費市場的活力。此外,許多家庭因房價下跌而承受財務損失,甚至在某些情況下面臨負資產的風險,這會進一步限制他們的消費意願。

在這一過程中,地方政府的財政壓力也會增大。許多地方政府依賴賣地收入來支撐基礎建設和公共服務的支出,而房地產市場不景氣會直接影響賣地收入,導致地方財政收入減少。這可能迫使地方政府在公共開支方面進行縮減,對區域經濟發展產生負面影響。

整體而言,未來中國房價的持續下跌不僅影響房地產相關行業,還可能對金融、消費和政府財政等多方面產生連鎖效應。經濟結構轉型的壓力下,房地產不再是經濟增長的主要驅動力,這將改變中國經濟的長期發展模式。

Whether China's housing prices will continue to decline is a complex issue influenced by multiple factors. Since 2021, the local real estate market has shown a significant downward trend. This is largely due to government policies, such as the “three red lines” initiative aimed at limiting the leverage ratios of property firms, pushing financial institutions to strengthen credit controls on developers, and addressing the economy’s overreliance on real estate. Additionally, structural issues like economic slowdown, declining population growth, slowed urbanization, continuous failures of property developers, and decreased housing demand have further contributed to persistent downward pressure on property prices.

The future of housing prices in China largely depends on policy changes. If the government continues to tighten real estate credit policies and restrict investment-driven speculation, housing prices may remain low or even decline further. However, if the government considers easing policies in response to economic growth pressures, the market might see a short-term rebound. Overall, the future trend in Chinese housing prices will be limited by the fundamentals of housing demand and supply, as well as the broader economic outlook. Particularly, the ongoing economic restructuring to reduce dependency on real estate may curb long-term growth momentum. In recent years, many industries have relocated, and the rising unemployment rate will likely lead to continued short-term declines in housing prices.

The current situation has already had a profound impact on multiple industries. Real estate developers and the construction sector are directly affected. As housing prices decline, developers face greater financial strain, with many large real estate firms even at risk of debt default and struggling with cash flow issues, which impacts construction progress. Meanwhile, reduced demand in the construction industry is also affecting related materials industries such as steel, cement, and glass, as these upstream industries are seeing corresponding declines in demand.

The financial sector is another key industry affected. Banks, long dependent on profits from real estate loans, face increased risks to financial stability due to declining housing prices and rising credit risks among property firms, which could lead to a higher non-performing loan ratio. Additionally, the downturn in the real estate market negatively impacts investment returns for trusts, insurance companies, and real estate investment funds, weakening overall investor confidence in financial markets.

Household consumption is also being affected. The wealth effect generated by rising housing prices has diminished, reducing consumer willingness to spend, particularly on durable goods like cars and appliances, further weakening the consumer market. Furthermore, many households are facing financial losses due to the decline in housing prices, and some may even risk negative equity, further dampening their consumption willingness.

During this period, local governments face increased fiscal pressure. Many local governments rely on revenue from land sales to support infrastructure and public services, and the downturn in the real estate market directly impacts land sale income, reducing local fiscal revenue. This could force local governments to cut public expenditures, negatively impacting regional economic development.

In summary, a continued decline in Chinese housing prices would not only affect industries directly related to real estate but could also have a ripple effect on finance, consumption, and government finances. Under the pressures of economic restructuring, real estate is no longer the primary driver of economic growth, which will ultimately reshape China’s long-term economic development model.

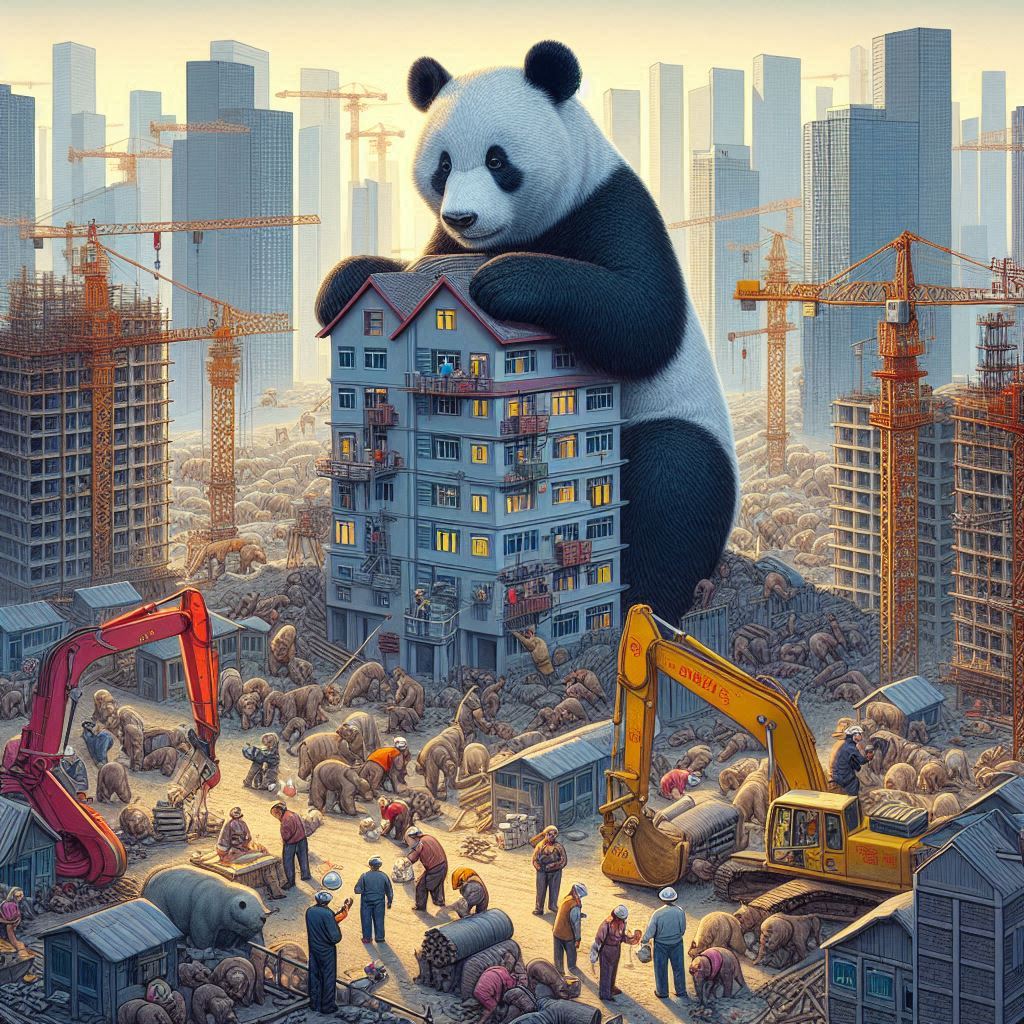

照片:DALLE3

- 1

- 2

- 3

- 4